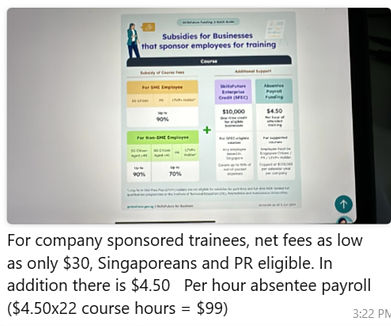

WSQ Course with up to 70% Funding for individual and companies, SFEC eligible, absentee payroll funding of $4.50 per course hour and Skill Future Claimable!!

New! UTAP and PSEA Claimable.

WSQ DIY Corporate Compliance: Accounts, Secretarial & Tax Essentials

-

Training on Do Your Own Company Accounts, Secretarial & Tax

-

Ad-Hoc Individual Corporate Accounting Coaching

-

Accounting, Tax and Secretarial Services for all Companies & Businesses

Upcoming Class Schedules

WSQ DIY Corporate Compliance - May 2026

Starts:

1,2,3 May 2026 (Fri(PH), Sat, Sun)

Full Course Fees:

S$ 1,000

After Subsidy:

From S$ 300

WSQ DIY Corporate Compliance - February 2026

Starts:

4/2/2026 - 6/2/2026 (Wed, Thur, Fri)

Full Course Fees:

S$ 1,000

After Subsidy:

From S$ 300

WSQ DIY Corporate Compliance - March 2026

Starts:

07/03/2026 - 08/03/2026 & 14/03/2026

(Sat, Sun, Sat)

Full Course Fees:

S$ 1,000

After Subsidy:

From S$ 300

Whatsapps us at +65-9736 8411 We will explain to you based on your case, the best funding available, absentee payroll eligible for claim, usage of your SkillsFuture Credit, SFEC and other fundings.

Absentee Payroll https://search.app/YWAR4aCzEFMdaMfe6

Thanks! Our Disclaimer on this site applies to our training.

Testimonials

Instructor has good technical knowledge, course provided the needed knowledge to be put into actual use.

Knowledgeable instructor. Well outline program

~Ng YL~

Sue is very patient and able to answer all the questions. Useful training resource, instructor demonstrated sufficient expertise in the subject area, course duration was just right."

~YP Chai~

To a very large extent, intention for attending the course was achieved"

~Director of a manufacturing Company~

Strongly agree that the content developed helped me develop skills & knowledge and to a very large extent, training received lead to improved performance at work"

~course attendee at Manhattan House, Chinatown~

Sue Kam is a very experience practitioner. Learning from her practical experience have me much more confident of applying the secretarial work, financial accounting, bookkeeping for my companies.

I will strongly recommend company's administration staff to attend this class. It is a very practical class and simple to understand. Help me save time and administrative cost now that I am more aware of the responsibility of a company.

Thank you Sue Kam."

~Bob Lim

We are able to conduct and arrange for private exclusive courses for companies sponsored CPF employees of at least 4 pax, inclusive of Directors whom are also CPF Employees. The applicable Government funding will be applied to private courses in the same manner. See Corporate Course Run *

* Only for Company Sponsored CPF Employees as the Government is imposing a minimum Quota of 40% Corporate Sign-up on us a Registered Training Provider from year 2027. We need to have progressive plan in place to meeting this condition.

Training on Do Your Own Company Accounts, Secretarial & Tax

WSQ DIY Corporate Compliance: Accounts, Secretarial & Tax Essentials

Accounting Short Course for SME, Singapore

For enquiries, email: suetcheng200@gmail.com or

Whatsapps 9736 8411 (Sue Kam)

Training on Do Your Own Company Accounts, Secretarial & Tax

Course Details

Conducted By: Kam Suet Cheng (Sue)

For Enquiry, Whatsapps Sue Kam at 9736 8411

Course Fee before funding: S$1,000/= (no GST) per participant.

Location: Singapore Polytechnic Graduates' Guild (SPGG),

3rd Floor Daisy Room, 1010 Dover Road, Singapore 139658.

Free Parking

This is about a 4* resort style training venue. Wheelchair friendly.

Lunch, tea breaks, snacks, coffee, tea included (professionally catered)

Course Timing:

March 2026 Course Run [Hurry! Filling up soon]

Saturday 7 March 2026 9am to 6pm

Sunday 8 March 2026 9am to 6pm

Saturday 14 March 2026 9am to 4pm

May 2026 Course Run

Friday (Public Holiday) 1 May 2026 9am to 6pm

Saturday 2 May 2026 9am to 6pm

Sunday 3 May 2026 9am to 4pm

Location: Blk 269 Queen Street #02-227 S180269

(Bugis) No Free Parking

This is a no frills training venue, Not Wheelchair friendly.

Lunch, tea breaks, snacks, coffee on us (our trainers will bring all trainees

for Halal lunch nearby with vegetarian option)

Course Timing:

February 2026 Course Run

Wednesday 4 February 2026 9am to 6pm

Thursday 5 February 2026 9am to 6pm

Friday 6 February 2026 9am to 4pm

January 2026 [FULL, REGISTRATION CLOSED]

Monday 26 January 2026 9am to 6pm

Tuesday 27 January 2026 9am to 6pm

Wednesday 28 January 2026 9am to 4pm

SMS or Whatsapps Hp: 9736 8411 for questions

Minimum qualification requirement is basic O Level or equivalent, no prior accounting knowledge is necessary. Must understand simple spoken and written English. Must be able to use computer at basic level such as scanning QR code for attendance, navigate internet.

Training Course coverage:

1. Company Incorporation

2. Prepare full set of financial statements (including Income Statement, Balance Sheet and Cash Flows)

3. Book Keeping for Full Set of Accounts

4. Company Secretarial Matters (Note#)

5. Tax Computation & Tax submission through Form C-S (for companies with revenue below S$5 million per year)

6. Brief browse on company and commercial law

Note#: According to ACRA (Filing Agent & Qualified Individuals) Regulations 2015, a Company Secretary would be regarded as a Corporate Secretarial Agent if he is carrying the business of providing Corporate Secretarial Services and has been a company secretary for at least 3 years.

This would basically covers all that is needed to handle a small or medium, solvent private limited company (revenue below S$5 million per year) with no corporate shareholders. A small company would therefore only incur $315/= for a one-off incorporation fee and a yearly recurring annual filing fee of $60/=. This training is also suitable for aspiring entrepreneurs, with or without Chartered Accountant qualifications, thinking of setting up a business in providing book keeping, accounting, secretarial and tax services. Please note that with the latest Corporate Services Providers (CSP) Act announced around mid 2024, there are certain limitations imposed on Corporate Secretaries providing such services as a business. During this course, we will provide some guidance on what can and cannot do and provide some guidance on some ways to overcome such barriers depending on various circumstances. For example, a sole director of a company cannot also be the company secretary of his/her company. This Director may have a family member who volunteers to act as Company Secretary of his/her company. During the course, we will provide other guidance on other can-do's despite the CSP Act. We can also assist aspiring persons who are into this area of work by explaining on how to navigate and also help in practical ways. Sue Kam Accounting Pte. Ltd., ourselves are an ACRA Registered Filing Agent (CSP). Thus, we can help suitable trainees to be a Corporate Service Provider as such suitable trainees can be attached to our Company (or recommend another CSP who allows such on-boarding or we may not provide this option at all) for this purpose or provide matching to our ex-trainees who are already ACRA Qualifying Individuals. We will also explain various ways for those aspiring to provide Corporate Services to navigate.

Although we cover basically the steps necessary for a simpler company, this course is suitable for those managing more complex companies up to $10 million in revenue or assets up to $10 millions as we do talk about more complex matters and give reference links for resources that entails more complex learning. Learners would then have these in mind and will be able to revisit them for more detailed learning.

Note: Accounting Software will NOT be taught in this training, although some trainees may discuss about this amongst themselves during lessons. We will also cover the using of ChatGPT, some advanced Microsoft Excel functions for expedient help in doing the necessary works.

Course also Includes:

Hard & Soft Copies of course materials (editable sample documents such as Financial Statements, Company Registers, Minutes, Cash Book, Book Keeping, our own developed Integrated Excel Accounts Template (one Excel file integrating bank account, Profit and Loss Account, Balance Sheet, General journal, GST Journal, Financial Statements, Tax Computations and AGM). This will show you how much time can be saved as figures are linked and formulas embedded to save time on not double keying in wherever possible. Our materials (hard and soft copies) are very carefully prepared with great passion such that it will be very useful to learners. Soft Copies of materials will be shared on Google Drive (two months access will be given) and participants' email address will be visible to other participants. You would be deemed to have given us consent to share your email address on Google Drive when you take up our services / products.

Fees include

-

WSQ Assessment (at no extra cost)

-

WSQ Statement of Attainment (no extra charge)

Others:

-

Free referrals and advertising trainees' businesses on our website (and/or our other channels) for those who opt in

-

This 3 days course includes lunch and 2 tea breaks every day of the course, with choice of vegan/halal options.

-

This course is held at SPGG, which has very conducive training rooms, breathtaking environment with great view of swimming pool and other scenery.

-

Those who have mobility problems and wheelchair participants should come in vehicle to the designated wheelchair accessible drop off lobby. That is because, the building itself from the point of drop off is wheelchair accessible but it may be difficult for disabled to come in from the main entrance with a carpark barrier at the entrance, although there is a side staircase for pedestrian walking in.

Disclaimer: Due to the inherent nature on these topics, we shall not be liable for any wrong, inaccurate or incomplete information or advice/s or help provided by us (including by the trainer/s or anyone connected to us) in relation to and after this training. We will give our best endeavour to facilitate/guide our training participant/s to successfully manage their own company accounts and regulatory compliance. Due to the sophistication of information technology now a days, we are unable to guarantee that all our downloadable soft copies of files are free from virus/es, though we do not install any virus ourselves. You are advised to use reliable virus protection software. Hard copies of materials will be given. In the unlikely event of any contingencies, we may need to cancel the training. If that happens, we will inform the participants and refund all fees collected in full to the participants, including SkillsFuture Credit collected by us. However, we have never cancelled any training before.

Our trainees may be added to our Whatsapps group chat (your phone number will be visible to other trainees) and our course materials will be shared with our current and past trainees on Google Drive. Trainees' mobile number, email addresses and other information such as profile names and pictures will be visible to other fellow current and past trainees and trainees are taken to agree to this. Trainees are not allowed to share whatever information on this training, Whatsapps group and Google Drive with any other person outside this group.

Interested participants, please SMS Sue Kam at 9736 8411 or email suetcheng200@gmail.com. Advance payment of S$188/= is required for the course fee to be paid to either "Sue Kam Accounting Pte. Ltd." or to "Kam Suet Cheng". We will inform you on the payment modes. See below for list of fundings available to individuals and companies. As there are alot of fundings, it can be very confusing. Please Whatsapps us at 97368411 so that we can advise you on the best fundings that may be available to you more quickly. Perhaps, after all the funding, you may not need to pay any cash.

Pte Ltd Company Secretaries Need Not Be Professionally Qualified

Note : Our Training is free from all kinds of paid advertising (No Paid advertising nor commissioned sales). During the training, we may refer you to certain sites, such as ACRA, IRAS or other websites as they provide the necessary information but we do not get any form of payment from them for advertising. As gratitude to our present and past training participants, we have created a referral page for our trainees to cast a wider net for their business. Trainees who would like us to list their services, please obtain the form from our Google Drive shared with you so that we can put up your business as in the form. This will enable a more conducive learning environment without such distractions and without the feeling of being obliged to various purchases or subscriptions.

Government Fundings at a glance:

-

Singaporean and Singapore PR 21 years old and above attending this course as individual eligible for WSQ funding of 50% off course fee, balance payable by SkillsFuture Credit.

-

Singaporean 40 years old and above, attending as individual, eligible for WSQ Funding of 70% off course fee, balance $300 payable by SkillsFuture Credit.

-

Singaporean, Singapore PR, Long Term Visit Pass Plus holders, Employment Pass Holders and Work Permit Holders whom are company sponsored, their sponsoring company, after completion of the course, will be eligible to claim SFEC up to 90% of unfunded course fee and absentee payroll of $4.50 per training hour. More details https://skillsfuture.gobusiness.gov.sg/support-and-programmes/funding/training-subsidies-for-employers

-

PSEA (Post-Secondary Education Account) For trainees who wishes to use their PSEA to pay for course fee, in whole or part, please Whatsapps us at 97368411 or email suetcheng200@gmail.com as we will help you to claim.

-

UTAP, where NTUC Union Members may, after completion of the course, claim 50% of the unfunded course fee, subject to the $300 or $500 claim cap per year, depending on age.

Register Now by Paying via PayPal Button below. After payment, please SMS 9736 8411 with your name and email address. Thanks!

Accounting, Tax & Secretarial Services

Contact us for Our Coaching for Accounting, Tax & Secretarial for your Company or Business.

-

Only available for our current and ex-training participants

-

Ad-hoc additional work. We can offer coaching for certain related ad-hoc work, such as filling up compulsory Government Statistical forms.

-

30% Discount for our current or ex-Training Participants.

-

All our services is subjected to our disclaimer : Sue Kam Accounting Pte Ltd (and/or Sue Kam), its staff, agents or contractors shall not be liable for any formal or informal advice/s, assistance/s or work/s given to anyone, whether contractual or not contractual and should be indemnified for services performed for our client/s, trainee/s or customer/s. And we will not be held responsible for any virus within our files we transmitted to you, due to sophistication of Information Technology nowadays, we can't have absolute control over this matter.

To Proceed, Whatsapps Hp: 9736 8411 or Email: suetcheng200@gmail.com

We are ACRA Registered Filing Agent